(Bloomberg): An investor wondering about the rise in US stocks on these two business days is whether the fall in the new year has dropped out.Might be so.However, two financial institutions have pointed out that there is a dynamic underwater that amplifies price movements and expose investors to further volatility.

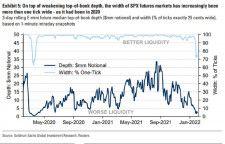

Rocky Fishman, such as the Goldman Sachtic Group, noticed that the market order absorption had deteriorated rapidly during the market confusion last week.Due to the significant loss of liquidity, indicators based on the S & P 500 -type stock index futures Bid Ask Spreaded have expanded to the level since the fall of 2020 due to the expansion of the new colonovirus.

The strategist centered on Marco Colanovich of the JP Morgan Chase has also confirmed the same liquidity deterioration.I noticed that optional traders that buy and sell stocks in the derivative (financial -derived product) hedge are currently taking the position of "negative gamma" (selling), which requires a significant tilt of existing market trends.。

Coranovic pointed out in a report, "As long as the S & P500 species remain below 4600, the dealer is a negative gamma that buys it when the market is solid and sells it when it is soft.""This will amplify the movement of the market, especially in the current situation where the market is low and low."

The market is still moving.On January 31, the stocks that had been sold, such as small and high -risk high -tech stocks, were led by the stocks that had been sold so far, and the US stock market expanded two business days.Goldman calculated high -tech stocks that have not yet been profitable have recorded an increase of 10 %, at least since 2014.The Nasdaq 100 index, which has a high specific gravity of high -tech stocks, has risen by more than 3 %, and the rate of 2 days is 6..6 % reached the level for the first time in one year and three months.

Original title:

Stock Chaos Revved Up by Options Dealers Rushing to Hedge (1)

(C) 2022 Bloomberg L.P.

Lu Wang, CRISTIN FLANAGAN