IoT業界は大きな発展が予想される分野であり、M&Aが活発に行われています。IoT industry market trendsやM&A・売却の動向、近年の事例、成功のポイントについて、図解も交えてわかりやすく解説します。(執筆者:京都大学文学部卒の企業法務・金融専門ライター 相良義勝)

目次- IoT industry market trends

- IoT業界のM&A動向

- Sales, partnerships, and capital increase examples of IoT companies 10

- Acquisition cases of IoT companies 3

- IoT企業のM&Aを成功させるポイント

- summary

IoT industry market trends

World IoT market trends

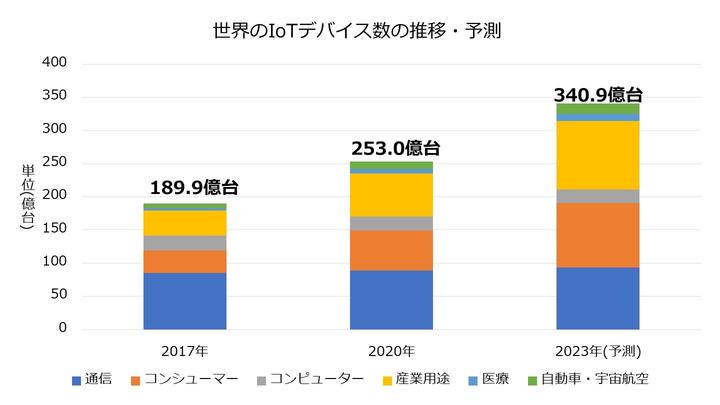

The IoT industry is an area where great growth is expected in the future.The number of IoT devices and terminals used in the world is steadily increasing, and it is expected that equipment for medical, industries, cars and space aerospace fields and products for general consumers will increase significantly in the future.increase.Figure: Changes in the number of IoT devices in the world and prediction order 3 years of information and communication white paper (Ministry of Internal Affairs and Communications)

Japan's IoT introduction status and market trends

At present, Japanese companies have a low IoT usage rate, and according to an IDC survey targeting companies with an employee size of 100 or more, the usage rate as of 2020 is 6..It is 8 %.Even if you look at it in time series, the increase in IoT usage is gentle, and there is still a feeling that full -scale introduction is still in the future.[1]

Nevertheless, the introduction of digital solutions such as IoT and AI is progressing as an unpleasant trend, and it seems that IoT -related expenditures and investments by companies on the IoT will continue to grow.increase.[2]

As of 2020, areas with relatively large expenditures and investments include electricity (smart grid / smart meter), automobiles (connected cars), smart homes (security, automation, home appliances), public infrastructure and information systems, retailed (retailed (Omni -channel), transportation (cargo management), etc.

Especially in fields that are expected to grow in the future include smart grid smart meters, public infrastructure and information systems, smart homes, in -hospital care systems, farm surveillance systems, and in -retail store promotion systems.

The impact of the corona's evil that continues since 2020 has extended to the IT industry, including the IoT industry, but the hitting is smaller than in other industries, and there is also a positive aspect that digitalization has accelerated due to corona evil.。It can be said that it is a relatively advantageous situation for the IT industry, and it is expected that strong growth is expected to grow in the future.[3]

It is expected that the amount of expenditure to the IoT infrastructure market will remain at a high growth rate.[Four]

M&A・事業承継【2021年最新版】IT業界のM&A事例56選

IT業界における厳選した56例のM&Aについて、「2021年の最新事例」や「システム開発分野」などのジャンルに分けて解説します。 事例では売り手・買い手企業の特徴やM&Aの手法、売買価格を紹介します。(中 […]

[1] Domestic IoT Market Corporation User Trend Survey Results (IDC) [2] Domestic IoT Market Industrial Section and Use Case Consideration (IDC) [3] Domestic IT infrastructure service market forecast(IDC) [4] Domestic IoT infrastructure market forecast (IDC)

IoT業界のM&A動向

IoT業界では技術開発やソリューションサービス提供での協業などを目的として活発にM&Aが行われています。IoT技術・サービスの開発を推進しているのはベンチャー企業・スタートアップ企業が多く、大手中堅企業が技術・人材の獲得やオープンイノベーションを目的としてそうした企業を買収・子会社化するという構図が典型的です。

As a sales side, joining a major group will stabilize the management base and proceed with technology and service development to the next stage.

子会社化・関連会社化しない範囲でIoT企業の株式を取得して協力関係を構築するケース(資本業務提携)が多いのも、IoT産業関連のM&Aの特徴です。売り手側としては資金の調達や相手企業の経営資源の活用により事業成長を加速することができ、買い手側としてはリスクを抑えつつ(段階的に)協業を進めることができるのがメリットと言えます。

IoTの用途は産業から生活まで多岐にわたることから、以下のような多様な業種の組み合わせでM&Aが行われています。

In addition, there are many investments in IoT ventures by funds.

In cases where IoT companies become buyers, the acquisition of system development aimed at strengthening development and human resources, and the acquisition of overseas peers is being carried out.

M&A・事業承継M&Aとは?目的・手法・メリット・流れを解説【図解でわかる】

M&A(エムアンドエー)とは、Merger(合併)and Acquisitions(買収)の略で、「会社あるいは経営権の取得」を意味します。今回は、M&Aの意味・種類・目的・メリット・基本的な流れ・税金・ […]

M&A・事業承継M&A市場の現状と動向 今後の展望も解説【2021年最新】

M&Aの市場は、後継者不足問題の深刻化などを理由に拡大してきました。しかし2020年は、コロナ禍の影響で市場が縮小しました。公認会計士が、M&Aの市場の動向および今後の展望を徹底解説します。(公認会計士[…]

Sales, partnerships, and capital increase examples of IoT companies 10

国内IoT関連企業が売り手側となったM&A(売却・資本提携・増資)の事例を紹介します。

[Production Equipment / IoT Software Development × Energy] JT engineering transferred the software business to Tokyo Gas

譲渡企業の概要

Jatical Engineering: Development, design, construction, and maintenance projects of production equipment and machinery and equipment, and develop and provide businesses for the IoT package software "JOY" series for various facilities, including factories [5]

譲り受け企業の概要

Tokyo Gas: Developing urban gas supply businesses in the Tokyo metropolitan area, power generation / power supply business, real estate business, etc. [6]

M&Aの目的・背景

Reduced company: Inherit the software assets and partner business networks of the "JOY" series and develop new business in the DX solution market [7]

M&Aの手法・成約

M&A・事業承継ソフトウェア業の売却・M&A動向と最新事例20選

ソフトウェア業に対するニーズがデジタル化などを背景として拡大し、ソフトウェア企業の売却・M&Aも活性化しています。ソフトウェア業の現況とM&A動向・事例、M&Aを行うメリットなどをくわしく解説しま […]

[IoT -related platform x SaaS] Plus style is BB software service and business integration

譲渡企業の概要

Plus style: Through the platform " + style" that connects the company that you want to create an IoT product and the state -of -the -art IoT product, we will develop a business that supports IoT -related product planning, sales promotion, marketing EC [9]

譲り受け企業の概要

BB Soft Service: Overseas company -wide software manufacturers' customization and distribution businesses for the Japanese market, and license sales and billing platform businesses for software vendors and suppliers [10]

M&Aの目的・背景

Transfer company / transfer company: Combine the know -how of both companies and expand IoT product sales and spread [11]

M&Aの手法・成約

M&A・事業承継ネットショップの売却価格相場や所要期間、最新事例を解説

The sale price of the online shop is one to three years of operating profit.In recent years, online shops using shopping malls such as Amazon and Rakuten have been actively sold.We will thoroughly explain the case and benefits of the sale.(Small and medium -sized enterprises Diagnostic Suzuki […]

[System Development / SES x Software Development] GH Integration is a subsidiary of Hoover Brain

譲渡企業の概要

GH Integration: In areas such as network infrastructure, 5G communication, IoT, AI, etc., we develop SES (engineer dispatch service) businesses with system contract development and major system integrators as major customers.

譲り受け企業の概要

Hoover Brain: Open businesses such as security measures support solutions using our own development security tools, business visualization / work style analysis solutions with monitoring and analyzing tools for self -development, tool introduction, operation support, maintenance service, etc.

M&Aの目的・背景

Transfer company: Use the reliability, brand, and funding of Hoover Brain's listed IT to expand and increase the value of business and strengthen the system to respond to next -generation technology.

Reduced company: Securing excellent engineers required to enter the new growth area

M&Aの手法・成約

成功事例最新のIT需要を取り込むために、 優秀なエンジニアを抱えるSIerをM&Aで完全子会社化

IT that holds the key to the Japanese economy.However, looking at the facts, the shortage of engineers is a serious problem in the rapidly growing fields in the IT industry.In addition to infrastructure -related network engineers, 5G, IoT, security -related altitude […]

M&A・事業承継システム開発・受託開発の最新売却・M&A事例、売却価格の相場

システム開発・受託開発会社の売却は、後継者不足などの課題を背景に増加傾向です。システム開発・受託開発会社の売却・M&A事例やメリット、売却価格の相場、高値での売却可能性を高める方法を徹底解説します。(中小企業診断 […]

[IoT System Development x Construction Consulting] Become a wholly owned subsidiary with long effects

譲渡企業の概要

Effect: Developed businesses such as contract development of embedded systems and in -house development of AI / IoT utilization system [13]

譲り受け企業の概要

Choi: Developing a construction consulting business for bridges, roads, rivers, ports, railways, etc. and service providers such as roads and public facilities. [14]

M&Aの目的・背景

Creation of IT -related new businesses in the public infrastructure area and expanded existing businesses [13]

M&Aの手法・成約

M&A・事業承継建設業のM&A動向・売却事例・メリット【2021年最新版】

人手不足や市場規模の縮小などの影響で、近年建設業界ではM&Aの件数が増加傾向です。この記事では、建設業のM&A動向や最新の売却事例、事業売却のメリット、M&Aを成功させるポイントをくわしく解説しま […]

[IoT Consulting x Consulting] Io -Japanese becomes a subsidiary of El Tee S

譲渡企業の概要

IoToy Japan: Introducing IoT technology and solution provision companies for companies that are considering new development of IoT business, and developing businesses on IoT business commercialization [15]

譲り受け企業の概要

El Tee S: Provides consulting services from strategy formulation to execution support for existing business reform, new business development, DX, etc. [15]

M&Aの目的・背景

Transfer company / transfer company: IoT business development consulting services such as supporting IoT Business business [15]

M&Aの手法・成約

M&A・事業承継システム開発会社のM&A動向と事例30選【2021年最新版】

システム開発業界は人材不足の慢性化やクラウド化の進展により過渡期を迎えており、M&Aが活発化しています。近年のシステム開発業界の動向と、システム開発会社の最新M&A事例を厳選して30例お伝えします。(執筆 […]

[IoT Development x Measurement Technology / IoT Development] Cynaps is a capital business alliance with Miho

譲渡企業の概要

Cynaps: Developed IoT equipment and IoT development operation platform planning, development and sales business [17]

譲り受け企業の概要

Miho: We have been working on planning, development and sales of various measurement technical devices and measurement systems for production, government, and learning for more than 70 years, and in recent years, we have developed IoT cloud services such as secretly avoiding and ventilation alert services [17]

M&Aの目的・背景

Reduced company: In cooperation with Cynaps, we will expand the IoT cloud service to the industrial and industrial measurement equipment field [17]

M&Aの手法・成約

[IoT Development x Printing / Information Service] Latna prints Dai Nippon Printing and Capital Business Alliance

譲渡企業の概要

Latna: Developing technology development projects in the IoT, edge computing, AI field, etc. [18]

譲り受け企業の概要

Dai Nippon Printing: Based on printing and printing technology, publishing businesses, marketing businesses, information security businesses, photo imaging businesses, packaging and package related businesses, internal and exterior materials, industrial high functional materials, and electronic device members business, etc.Development [19]

M&Aの目的・背景

Transfer company: Procurement of funds for technology development and business expansion [18]

Reduced company: Through the technology of the company's strengths and the strengths of the ratona (high security and low cost, which is a characteristic of the edge computing field), through techniques such as object recognition and face image recognition.Retail, manufacturing and entertainment industry strengthens solution provision ability [20]

M&Aの手法・成約

M&A・事業承継印刷会社の売却動向やメリット、近年の事例をくわしく解説

市場規模が縮小するなか、印刷業界ではM&A・会社売却により現状打開を図る動きが活発化しています。印刷業界の課題と現状打開の動き、印刷会社の売却動向、売却のメリット、最新の売却事例を解説します。(執筆者:京都大学文 […]

[Living space IoT x crime prevention / security] LIVESMART is a capital tie -up with SECOM

譲渡企業の概要

LIVESMART: Provides a living space smart platform using AI and IoT for energy operators and real estate operators [21]

譲り受け企業の概要

SECOM: Developed businesses for personal home security, security, disaster prevention, and elderly people, security for corporations, security, disaster prevention, disaster prevention, disaster measures, and attendance management services [22]

M&Aの目的・背景

Transfer company / transfer company: Construction of cooperation in the platform business that contributes to "safe, secure, comfortable, and convenient" living [21]

M&Aの手法・成約

M&A・事業承継警備業界のM&A動向や事例10選を徹底解説【2021年最新】

市場が拡大傾向にある警備業界では、人手不足などの課題解決手段としてM&Aが活用されています。警備業界のM&A動向や最新事例、M&Aのメリット、売却・買収の成功可能性を高めるポイントを徹底解説します […]

[Solar Power IoT x Construction] Hirasol Energy carries out a third -party allotment of a third party with Tokyu Construction.

譲渡企業の概要

Hirasol Energy: AI / IoT develops remote monitoring data analysis platform that maintains solar power generation equipment in panels. [23]

譲り受け企業の概要

Tokyu Construction: Developing businesses such as civil engineering work for public infrastructure, public and private construction, real estate acquisition and rental [24]

M&Aの目的・背景

Reduced company: A part of a strategy to create new growth opportunities through investment in venture companies [23]

M&Aの手法・成約

M&A・事業承継建設業の売却額はどのくらい?高額で売却するポイントと注意点

In order to increase the possibility of successfully selling the construction industry, it is important to hold down the unique points in the construction industry.We will explain the details of the construction method of the construction industry, the factors that affect the sale amount, and the points to note regarding permit.(Corporate Law of Kyoto University's Faculty of Letters […]

[A perinatal medical care IoT x fund] Melody International has a third-party allotment increase with KYOTO-ICAP 2 fund

譲渡企業の概要

Melody International: A venture company from Kagawa University, share the measurement result of the device between pregnant women, clinic doctors, core hospitals, etc., with a delivery monitoring device that measures fetal heart rate and pregnant woman's stomach tension.Developed the platform "Melody I" that realizes remote medical communication [25]

譲り受け企業の概要

KYOTO-ICAP 2 Fund: A fund operated by Kyoto ICAP (Kyoto University Innovation Capital), an investment and business support company established by Kyoto University, targeting venture companies from Kyoto University and other national universities.Developed [25]

M&Aの目的・背景

Transfer company: Acceleration of business growth

Reduced company: Part of the investment business [25]

M&Aの手法・成約

M&A・事業承継M&Aにおけるファンドの役割 種類やメリット・デメリットも解説

M&Aで投資ファンドは、出資等を通じて企業価値を高め、株式売却などで利益を得ることを目的とします。M&Aにおけるファンドの役割や種類、ファンドとM&Aを行うメリットとデメリットをくわしく解説します […]

[IoT system construction x fund] MOMO implements a third -party allotment increase with Minato A fund underwriting

譲渡企業の概要

MOMO: Develop and provide the platform "Palette IoT" that can easily build an IoT system based on more than 50 types of sensors and 5 types of communication standards, IoT system products using the same platform (smart agricultural tools and snowfall automatic.Development and sales of measurement systems, such as joint development and contract development of IoT -related software [26]

譲り受け企業の概要

Minato A fund: A fund founded by Minato Bank and Minato Capital, developing investment businesses for agriculture, forestry and fishermen and businesses involved in agricultural, forestry and fisheries [27]

M&Aの目的・背景

Transfer company: Procurement of business growth and financing to strengthen the internal system [28]

Reduced company: As part of the investment business

M&Aの手法・成約

[5] Company Profile (Geity Engineering) [6] Business introduction (Tokyo Gas) [7] Transfer of software business in Japan (Tokyo Gas) [8] Start of sales of the software "JOY Series" (Tokyo Gas)[9]+style (plus style) [10] Business model (BB software service) [11]+STYLE business information (BB software service) [12]+STYLE's operating company change (plus style)) [13] Strengthening the promotion of infrastructure technological innovation due to a full wholly owned subsidiary of effects (14] About the length of the year (long large) [15] Notice of the consolidated subsidiary of IOOJAPAN (El Tea S) [16]In the company's system (17] In the CYNAPS, we had a business alliance (Miho) [18] In the Series A EXTENSION Round, we implemented funds from Dai Nippon Printing (Ratna) [19) [19) [19)] Business area (Dai Nippon Printing) [20] Capital Business Alliance with Latna (Dainippon Printing) [21] Concluded a capital alliance contract with SECOM (LIVESMART) [22] Top page (SECOM) [23] With Hirasol EnergyConcluding investment contracts (Tokyu Construction) [24] Business contents (Tokyu Construction) [25] Conducted third -party allotment capital with "Kyoto ICAP" (melody International) [26] Top page (MOMO) [MOMO)27] About the establishment of "Minato A Fund" (Minato Bank) [28] Investment by "Minato A Fund" (Resona Group)

Acquisition cases of IoT companies 3

国内IoT関連企業が買い手側となったM&A(買収・合併)の事例を紹介します。

[Semiconductor x semiconductor] Renesas Electronics makes Dialog Semiconductor a wholly owned subsidiary

譲渡企業の概要

Dialog Semiconductor: British companies that provide semiconductor products for IoT, home appliances, automobiles, and industrial fields with low power and connectivity technology [29]

譲り受け企業の概要

Renesas Electronics: Development of various semiconductor products centered on microcomputers and SOC (System-on-A-chip) products and built-in solution provision projects such as IoT systems using their own products [30]

M&Aの目的・背景

Transfer company: Renesas Electronics Products / Technical Infinus, Sales and Customer Support Enhancements Extensions of Growth Misses

Reduced company: Expanded the product portfolio by acquiring the technical assets of Dialog Semiconductor, which has a complement to our own technology and product groups, strengthening the power of solutions for high -growth marketing in the IoT, industry, and automotive fields [29]

M&Aの手法・成約

M&A・事業承継製造業のM&A・売却動向や最新事例、価格相場を徹底解説

製造業のM&Aは、主に大手企業への傘下入りやIT化を目的に行われます。今回の記事では、製造業のM&A動向や最新・有名事例、メリット、相場、成功させるポイントをわかりやすく解説します。(中小企業診断士 鈴木 […]

[Wireless communication / IoT platform x IoT construction] Meritech makes Eoxys Systems India a subsidiary

譲渡企業の概要

EOXYS Systems India: Indian companies that provide IoT and cloud solutions for telecommunications carriers and general corporations [32]

譲り受け企業の概要

Meritech: Develop and provide IoT platforms for wireless communication, mobile networks, and monitoring software products and IoT platforms for communication, industry, and medical treatment [33]

M&Aの目的・背景

Reduced company: Strengthening the base of the IoT solution business [32]

M&Aの手法・成約

M&A・事業承継クロスボーダーM&Aとは?メリットや手法、有名事例を徹底解説

クロスボーダーM&Aとは、譲渡企業か譲受企業のいずれかが海外の企業であるM&Aです。近年増加傾向にあるクロスボーダーM&Aの目的や手法、有名事例、成功に導くための注意点をわかりやすく解説します。(公認会計 […]

[IoT / AI Development x System Development] Riconomical absorbs Kaname

譲渡企業の概要

Kanamei: Developed and operated businesses for large -scale systems, websites, etc. [34]

譲り受け企業の概要

Reconnomical: Developing businesses such as technology development and business development in AI, IoT, AR, RPA field [34]

M&Aの目的・背景

Transfer company / transfer company: Speed up and improve business efficiency by fusion of personnel and know -how [34]

M&Aの手法・成約

M&A・事業承継Webメディア売却の事例や相場を徹底解説【2021年最新版】

The market for sale of web media has been expanding in recent years, and various types and scale media have been sold and sold.We will explain the trends of web media sale, the latest cases, benefits, and the market price of the sale amount.(Author: Corporate Legal Affairs and Gold, a graduate of Kyoto University's Faculty of Letters […]

M&A・事業承継M&A成功事例40選 大企業・中小企業・業界別|2021年版

今回は大企業・中小企業別、業界別に厳選したM&A事例40選を紹介します。国内・海外の大企業事例から中小企業事例まで、譲渡・譲り受け企業の概要、M&Aの目的・M&A手法、成約に至るまでを解説します。 […]

[29] Acquisition of Dialog (Renesas Electronics) [30] Top page (Renesas Electronics) [31] Completed the acquisition of Dialog (Renesas Electronics) [32] Acquired EOXYS Systems India (Meritech) [33] Top page (melitech)[34] Absorption and merger of system development (reconamical)

IoT企業のM&Aを成功させるポイント

Points for both the selling side and the acquisition side

相性のよい相手を積極的に探す

M&Aの成否は売り手企業と買い手企業の相性(統合により生じるシナジーの大きさ、経営方針・組織文化・ITシステムの親和性など)によるところが大きく、相手企業とのマッチングが重要なポイントとなります。

近年ではM&Aマッチングサイトなどが普及したことにより、幅広い候補のなかから有望な相手企業を探したり、リアルタイムで売却・買収ニーズをチェックしたりすることが容易になりました。そうしたサービスを利用して相性のよい相手を積極的に探し出すことが、M&Aを成功に導く大きな鍵です。

技術の権利関係をチェックする

製品やサービスに利用している技術や新規開発技術の権利関係(権利の帰属、ライセンス契約の内容など)が、M&Aを機に大きな問題として浮上するケースがあります。

権利関係が不明確だったり、M&Aによる承継や契約の移転・継続が不可能な内容だったりすると、M&A後の事業展開に大きな支障を来したり、第三者とのトラブルが発生してその対処のために過大なコストがかかったりする恐れがあります。

This is a great risk for the buyer, and it is not another person's affair for the seller integrated into the buyer.The magnitude of the risk can also be a factor in reducing the transfer price.It is necessary to check in detail about the rights of the technology, and carefully consider and discuss the response if there are any problems.

人材流出・モチベーション低下に注意する

M&Aによる職場環境・労働条件などの変化が人材流出やモチベーション低下を引き起こす例が少なくありません。IoT開発事業においては人材力が主要な経営資源のひとつであり、キーパーソンの流出や人材の大量流出などが起これば致命的なダメージにつながる恐れがあります。

It is necessary to pay attention to human resources -related issues on both the seller and the buyer, and to consider and discuss sufficiently from the negotiations.

M&A・事業承継M&Aで従業員はどうなる?雇用や待遇などへの影響を徹底解説

M&Aを実施すると、従業員の雇用契約が継続されるなどのメリットを得られます。ただし、円滑な雇用の引継ぎには、従業員の不安解消が重要です。M&Aが従業員に与える影響やメリットをくわしく解説します。(公認会計 […]

Points for the selling side

売却を視野に入れて事業を展開する

The option of selling a company / business is one of the basic strategies for business growth, and for entrepreneurs, it is also a way to collect investment and expand the next development.

By developing a business with the option of selling in the medium to long term, it is more likely to be sold to powerful buyers in good conditions.

競業避止義務に留意する

事業の一部を切り離して譲渡する売り手企業や、M&Aを機に会社を離れる経営者・役員などに対しては、M&A契約で競業避止義務(一定の範囲・期間において売却対象と競合する事業を行うことを禁じる取り決め)が課されるのが一般的です。

競業避止義務の対象範囲・期間によってはM&A以降の事業展開の大きな足かせとなる可能性があるため、買い手側と十分に協議して落としどころを探る必要があります。

M&A・事業承継会社売却のメリット・デメリット 相場や事例、従業員の処遇も解説

The method of selling the company, the flow of procedures, the calculation method of the market price, the difference between the transfer of shares and the business transfer will be explained in an easy -to -understand manner.It also explains the impact of the company's sale on employees and managers.It is a must -see for managers who want to sell the company.What is the sale of the table of contents?company […]

summary

IoT業界は市場拡大が大いに期待できる分野であり、オープンイノベーションなどの観点からM&Aが盛んに行われています。IoT企業にとってM&Aは基本的な事業戦略のひとつと言え、今後ますます活発に利用されていくものと予想されます。

(執筆者:相良義勝 京都大学文学部卒。在学中より法務・医療・科学分野の翻訳者・コーディネーターとして活動したのち、専業ライターに。企業法務・金融および医療を中心に、マーケティング、環境、先端技術などの幅広いテーマで記事を執筆。近年はM&A・事業承継分野に集中的に取り組み、理論・法制度・実務の各面にわたる解説記事・書籍原稿を提供している。)