Based on the weekly news released by the Korean launch media "Startup Recipe", this paper reviews the trend of the start-up scene and the trend of fund-raising in South Korea.

Copyright 2021 ©Media Recipe. All Rights Reserved.

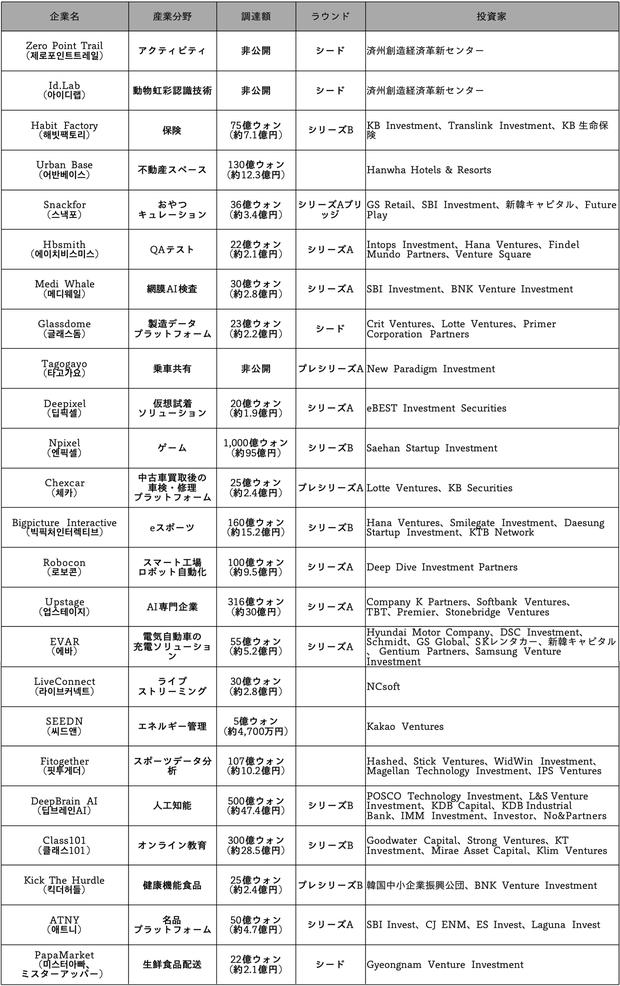

In the procurement launched in South Korea from August 30 to September 3, 21 purchases were disclosed, with a total amount of 303.1 billion won (about 28.8 billion yen).

Major start-up investment

Trend Analysis:

初期からヒットの兆しが見えるスタートアップが持つ共通点

Carrot Market raised 173.9 billion won (about 16.5 billion yen) last month, with a total market capitalization of 3 trillion won. The total market capitalization has increased 70-fold in three years, joining the Unicorn Club for the first time in six years. Last week, game company Npixel also became the shortest unicorn in the game industry. Startups like this that have exploded in a short period of time have emerged, and the trend of obtaining venture capital that can see signs of heat in the early stages is also active. Perhaps for this reason, it is less than a few years old, or the start-up of receiving love calls from venture capital at high valuations is increasing before the start of the service.

In round A (GokutsugerX) of AI's start-up VoyagerX series, it is hard to see that a large-scale financing of 30 billion won (about 28.5 billion yen) has been implemented. VoyagerX was founded by Mr. Nam Sedon, who has successfully developed services such as "SayClub" of 1 noon,NeoWiz, a search engine operator acquired by Naver, and "B612", Naver's selfie camera app. Service for AI-based video editor "VREW", mobile scanner "vFlat" and so on. It is a company with strong development ability and driving force.

In Series A, AI launched Upstage (production Department) and also raised 31.6 billion won (about 3 billion yen). Founded in October last year, the company was founded by Jin Songxun (Rongrong), a former AI leader of Naver "CLOVA". Provide AI solutions for enterprises. Eight months after its establishment, corporate customers received sales of 8.8 billion won (about 840 million yen). The establishment of a Hong Kong branch and overseas expansion are also under way.

RXC (producer) raised 20 billion won (about 1.9 billion yen) of seed money at the same time, which attracted attention. RXC is a new generation of business platform set up by Ms. Yu Hannick, former chairman of TMON (Channel, Ticket Monster). With real-time commerce and content marketing as the center to launch curatorial commercial shopping applications, and revealed plans to provide a number of brands and celebrities, affected D2C media business platform. The first service will be launched by the end of this year.

AI semiconductor company Rebellions raised 14.5 billion won (about 1.38 billion yen) in the previous series A. This is the most eye-catching start in the field of AI semiconductor design, which is the core technology of the four industrial revolutions. It is composed of a team of engineers who have worked in IBM, ARM, Intel and other global semiconductor companies, and plans to launch products next year.

Marqvision, a fake goods monitoring platform based on AI, recently completed the purchase of 6 billion won (about 570 million yen) in the seed wheel. Marqvision provides solutions to eliminate counterfeit products on the e-commerce platform and expands its business in the area of IP protection. Marqvision was also selected as Y Combinator's training program and set up a global headquarters in Los Angeles for real global market goals.

If you take a closer look at these startups, you will find similarities. First of all, have a business model aimed at the global market and technical capabilities at the global level. Entrepreneurs have a successful resume as serial Antreprena, or senior people in the industry come together as team members. In addition, attracting investment from global venture capital is also similar to Li, AI technology-based enterprises.

To sum up, the strength of entrepreneurs and market growth, globalization, excellent technical capabilities and talents and other start-ups, early stage investors pay attention to the growth of it.

[via StartupRecipe] @ startuprecipe 2

[original]

BRIDGE Members

BRIDGEでは会員制度「BRIDGE Members」を運営しています。会員向けコミュニティ「BRIDGE Tokyo」ではテックニュースやトレンド情報のまとめ、Discord、イベントなどを通じて、スタートアップと読者のみなさんが繋がる場所を提供いたします。登録は無料です。無料メンバー登録