政府は2022年度税制改正で、住宅ローン減税の見直しを最終調整しています。「年末時点のローン残高の1%」としている控除率を0.7%に引き下げる見通しです。

合わせて、期間を現在の10年間から13年間に延長することも検討されています(期間に関しては検討中)です。

税制改正大綱で住宅ローン減税の控除率の引き下げが決まれば、現在の条件(1%控除)の適用を受けるには2021年末までに入居となりそうです(※配慮される可能性もありますが)。

また、消費税率の引き上げに伴って拡充をしている一般住宅の上限4000万円を、再来年の入居分までは3000万円に引き下げるとしているようです。

How specifically, this amendment has a specific impact?

For example, for 10 years, 1 % deduction and up to 400,000 yen each year (up to 40 million yen) can receive a deduction of up to 4 million yen.

However, if it comes to new conditions, 0 for 13 years.7%控除、毎年21万円まで(3000万円が上限)と仮定すると、最大で273万円の控除となります。最大の控除額は127万円も少なくなってしまうのです。

また、対象者の合計所得金額も3000万円以下から2000万円以下に引き下げる予定です。

Should I rush to buy my own home before the mortgage tax cut and the revision?

それなら新基準になるまでに急いで契約をしたほうがよいのでしょうか。1%の間に駆け込むには年内入居が条件となるので非常に難しいでしょう。

I recommend that you think about whether you should buy a house or rent without being caught by the immediate preferential treatment, and do not overdo it until there is a property without a compromise when you buy it.

It is more important to consider life planning and budget management.If you stretch out and buy a house when you are a couple only, it will be difficult when there is a change in the couple's career contract or family plan.If you rent it, it can be changed at any time, but if you buy it, it will not do so.

The trader may calculate and make a proposal to the couple's credit Max.However, once you borrow, it is difficult to review and repayment continues.

As with all online shopping, there is no source or child if you lose your ginseng, incentives, or discounts.If you dispose of unused items with Mercari etc., you may return money, but it takes time to sell real estate.

If the purchase is progressing, it may be better to hurry.Especially in the case of high -income earners, there is a possibility that tax reductions may not be accepted.

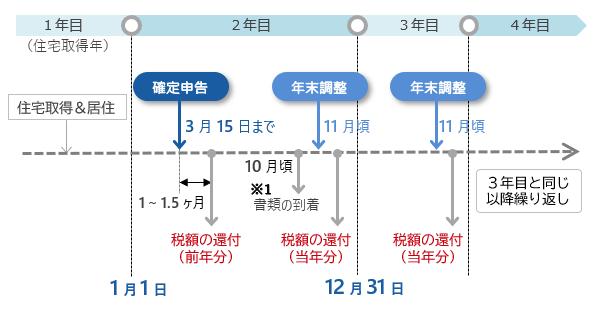

* Please check the mortgage deduction on the tax office website for details because the deductions that can be received differ greatly depending on the year for residence.

of.1213 When newly built a certified house (special deduction such as housing borrowing)