"Resident tax decision notification" distributed from work every year around May or June.When I was a company employee, I was looking at it somehow, but did you know that you may lose if you don't look closely?This time, I will explain the view of the resident tax decision notice.

What is the residence tax in the first place?

住民税とは、市町村民税と道府県民税の2つを合わせた税金のこと。東京23区では特別区民税・都民税と呼ばれます。

Every year as of January 1, you will pay together to the municipalities with your address.Taxes will be used for local government administrative services.

住民税決定通知書とは、住民税の金額が決まったことを知らせる書類になります。住民税の年度は6月始まりで、翌年5月末までとなっています。そして、6月から翌年5月まで給料から前年分の住民税が天引きされます。新入社員の場合、住民税が2年目のこの時期から徴収されるので注意が必要です。

If you are a freelancer or sole proprietor, the resident tax tax decision letter will be mailed under the name "Tax decision and tax payment notice".Use this payment slip to pay the resident tax all at once or four times a year.

By the way, the amount of resident tax is determined by the total income and equal amount.The amount of income is calculated according to the income of the previous year.The per capita rate will be the same amount of the same amount for those who have a certain income.

Checkpoint of resident tax tax decision notification

There are three main checkpoints in the resident tax tax decision notification that the company employee should check.

1) Income

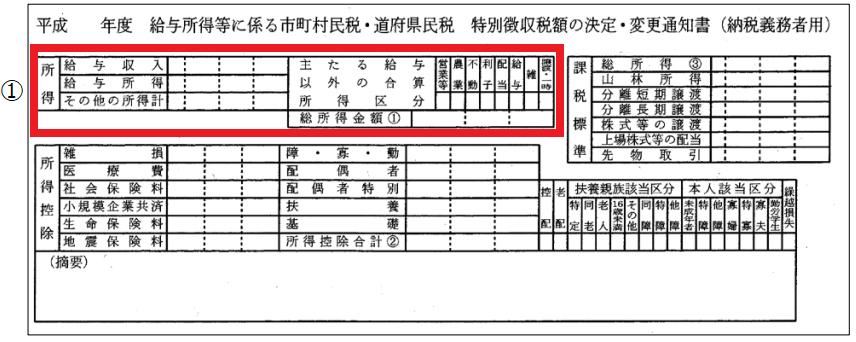

First, check your salary income and salary income in the income column.

Think of salary income as the remaining amount that subtracts the expenses acknowledged by office workers, such as income and income deduction from income.

At the end of the previous year, you should have received a "withholding slip for salary income" from the company.Find the documents, check the "payment amount" and "amount after deduction of salary income" for the salary, and check if it is the same.

2) Income deduction

Next, check the income deduction column.Income deduction is the expense recognized by office workers.

There are 14 types of income deductions.

There are differences in the conditions and amounts that can be deducted.The amount of these deductions from the salary income is the taxable income.Each person has various circumstances, such as having dependents such as spouses, children, and having a chronic illness, and can reduce taxable income.

There are income deductions that can be filed at year -end adjustments and income deductions that cannot be filed unless you file a tax return.Make sure that the amount deducted in the "Income Deduction" column is leaked.

3) Tax amount

Finally, let's check the tax section.

In the municipal tax and prefectural tax column, the tax deduction before income, tax deduction, income percent, and equal amount are described.The amount of tax rate on the taxable income is described in the income percent of the tax deduction.

The tax rate is 6%for municipal taxes and special ward taxes, 4%for prefectural taxes and metropolitan taxes (government -designated cities are 8%municipal tax and 2%prefectural tax).

The amount of the income rate is the amount of the tax deduction amount from the income rate before the tax deduction (discarded less than 100 yen).

If you have paid your hometown tax, or if you have a mortgage deduction, tax deduction can be applied (more tax deductions will be deducted from the income percent of the tax deduction).Make sure that the declared amount is reflected.

Until 2023, the prefectural tax and Tokyo private tax are 1500 yen, and the municipal residents and special ward taxes are 3500 yen (some areas are different).From these, the payment amount of the resident tax will be determined.

Is it taxable or tax -exempt to handle corona benefits?

What will happen to Corona -related benefits?

特定定額給付金(10万円)や子育て世帯への臨時特別給付金のような給付金は非課税となります。

他方で、事業に関して給付される給付金等は課税対象となります。例えば、持続化給付金(事業所得者向け)、家賃支援給付金、県・市事業継続給付金など。

また、事業に関連しない給付金等で臨時的に広く一般に支給される給付金等は一時所得に分類されます。例えば、持続化給付金(給与所得者向け)、子育て世帯への応援給付金、育児応援金支給事業等です。

一時所得に関しては、所得金額の計算上、50万円の特別控除が適用されます。ほかの一時所得とされる金額との合計額が50万円を超えない限り課税対象にはなりません。

In addition, sustainable benefits for miscellaneous income are divided into miscellaneous income.If you have any questions, you may want to check with your local government.

However, in the case of a company employee, there seems to be more tax -exempt unless it is a very special case.If you are running a business, please check the taxation relationship.

Finally, there is a case where a resident tax tax decision notice is required.For example, when applying for a mortgage, you may use a resident tax tax decision notice when you judge your income.If you lose it, you will not be able to reissue it and keep it so as not to lose it to order another document.

[This article was jointly planned by the Yahoo! News Individual Editorial Department and the author about the content and wrote by the author.